While I personally consider getting an aftermarket warranty for a used car, such as what’s covered and the plans offered by Warrantywise here in the UK, a necessity, particularly if you own a car that could prove costly in repairs and servicing, I know that there are those who find it tough to justify the added price of monthly or yearly premiums for getting that aftermarket warranty. Besides, owning a car is hardly cheap these days.

Therefore, I’d like to try and highlight, as well as elaborate further, on the many advantages and upsides a good aftermarket automotive warranty would offer for your car and ownership experience. Of course, I do know that aftermarket warranties aren’t perfect, and there are some downsides that you have to consider. These include the often high (yet justified, in the end) monthly or yearly premiums that you have to pay.

Even if your car has proven reliable and hasn’t yet made a visit to a garage, you’ll still have to pay those premiums, regardless. Moreover, there’s the fact that every aftermarket warranty has a plethora of terms, conditions, and other exclusions as well as fine print that you have to revise beforehand, just so you know what’s covered under the warranty, and what isn’t. As such, my recommendation isn’t as straightforward.

Nonetheless, I do think, that despite some of these flaws and caveats that you need to take into account, a comprehensive, in-depth aftermarket warranty for your used car (which is no longer covered by the factory warranty) is still a must-have. So, here are some of the benefits of applying for, and getting an aftermarket warranty plan, such as Warrantywise’s warranty offerings, for your car, just like how I’ve done for mine…

1. Giving You That Added Peace Of Mind

One of the best things about getting a brand-new car is the fact that you have that factory warranty that’ll be a lifesaver when things go wrong. Understandably, not everyone has the privilege of buying a brand-new car, so we have to shop around in the second-hand market, often once their warranties have expired.

Thankfully, there are loads of aftermarket warranties that you could purchase to extend what is covered and provide you with added peace of mind, knowing that you have a financial safety net when problems do appear on your car. In this case, at least some (if not, all) of the repair costs are covered by the warranty.

This is especially so given that some car repairs can cost you a lot of money, particularly for more complex issues, such as transmission failure or blown head gaskets. To be clear, it’s worth bearing in mind that any aftermarket warranty doesn’t provide blanket coverage for everything, so when it comes to exclusions, it’s your responsibility to check what is and what isn’t covered.

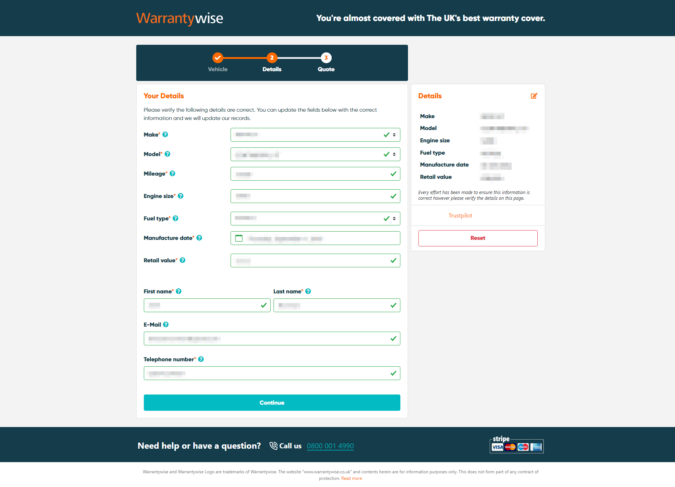

Aftermarket warranty providers, such as Warrantywise, make this absolutely clear to you beforehand, so make sure you double-check and study their respective FAQs and warranty details in depth prior. For example, with Warrantywise (they have a detailed list of what they won’t cover), they won’t cover well-recognised manufacturing faults or defects with your car.

As such, if a particular car is known for power steering failure due to a design flaw, make sure you check with the car manufacturer beforehand if there was a previous recall to fix this. Other noteworthy exclusions that won’t be covered are neglect from the car’s owner. So, if something fails because you didn’t service it properly, don’t expect to get a payout here, either.

2. Hedging Your Bets On Repair Costs

Moreover, an aftermarket warranty for used cars could allow you to hedge your bets. This is because when something does go wrong and if those repairs could otherwise cost you a lot of money, it’s better to have a warranty to lighten those expenses, rather than having to cover all those repair costs out of pocket.

Sure, this particular point is a bit of a double-edged sword. If your car has proven reliable and fault-less, it’s understandable that some could not justify paying hundreds or thousands of pounds every single year for a warranty that hasn’t done anything. However, the chances of this happening aren’t always as likely.

Even the most reliable cars on the second-hand market, such as Hondas and Toyotas, are still susceptible to some faults. This is more so if those cars are older, and the shelf-life of certain, pricey components is near, such as engine or transmission components. Therefore, it’s worth having these warranties cover them. Granted, there is a timeframe to be cautious about.

There is no such warranty provider or plan that pays out for items that have come to the end of their natural life – this is to be expected. Automotive parts and cars in their entirety die out at some point, to an extent where warranties no longer apply. Warranty providers will make this clear, mentioning the age (years) and mileage (km/miles) that they’ll cover up to.

Once again, taking Warrantywise as an example, their 12/120 Bronze plan (among the other plans they have, covering different ages and mileages) covers vehicles up to 15 years old and with under 150,000 miles on the odometer, from the time of manufacture. Beyond that, you won’t get coverage. Expect that an ageing car won’t be covered the same as a brand-new car.

3. Minimising Your Losses With Expensive Repairs

Additionally, when parts of your car do fail and require repairs, an aftermarket warranty would easily help to reduce the financial downside. Remember that complex parts of a vehicle, such as the drivetrain or your suspension or steering assembly, could cost you thousands of pounds in repairs when stuff goes wrong.

Meanwhile, if you do have an aftermarket warranty to cover that, you can minimise your potential losses, since it’ll limit your downside and the repair costs to however much you’re paying in the monthly or yearly premiums. (That’s assuming, of course, that those repairs don’t breach the maximum, per-repair limit).

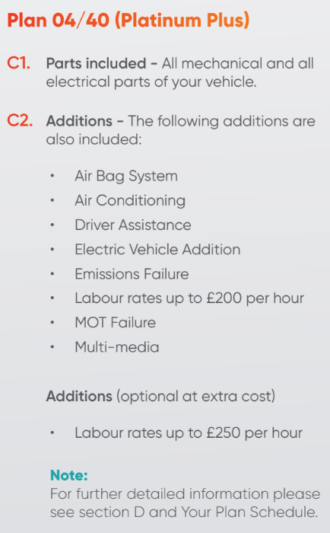

Naturally, the effectiveness of this depends on which particular warranty you’re getting. In the case of my aftermarket warranty provider of choice, Warrantywise, they offer rather generous coverage limits for their diverse array of warranty plans, and they even cover the labour hours involved in repairing your car. With that being said, you’re still responsible for caring for your car.

My general mindset when it comes to automotive warranties is to treat it as a safety net and a last resort. In other words, I don’t expect that Warrantywise or any other warranty provider will provide payouts for 100% of the issues that I have with my car, particularly if the underlying problems or cause of the issues that I have with my car, are entirely my fault, due to negligence.

It’s still your duty to regularly maintain and service your car, with or without a warranty in place, so it shouldn’t be a shock if your warranty provider declines a payout for any repairs if your car isn’t serviced right beforehand. As such, don’t be surprised if they won’t pay for a new transmission if you haven’t performed proper and regular transmission fluid changes in the past.

4. Transferability & Potentially Increased Resale Value

Another nice feature that some aftermarket warranties offer, like what Warrantywise covers, is that they’re transferrable to a new owner. So, if you do decide to sell your car while that aftermarket warranty is still in effect – bearing in mind the specific terms and conditions – it could be transferred to the new owner.

This has the impact of making your car’s listing appear a tad more appealing to would-be buyers, given the fact that they could gain some added peace of mind while that warranty is still active, after they’ve bought your car. Furthermore, this could also help elevate your car’s resale value on the second-hand market.

Once again, most buyers are typically more inclined to purchase a used car that comes with a warranty, as it reduces their perceived risk. This can be a great selling point when you decide to sell or trade-in your car. Though it might be costly in monthly or yearly premiums, a warranty might be worth it in the end.

5. Additional Quality Of Life Perks & Conveniences

Some aftermarket warranties come with extra benefits and quality-of-life conveniences that could be really handy when things go wrong, or in the case of a roadside breakdown. Taking Warrantywise as an example, they offer a plethora of emergency services (if applicable), such as 24/7 roadside vehicle recovery.

On top of that, Warrantywise could also plan a car hire for you, if your own car is undergoing repairs, and isn’t accessible. Alternatively, (if applicable) Warrantywise could further help you out by paying in part for overnight expenses, if you broke down on the road, as well as paying for alternative travel expenses.

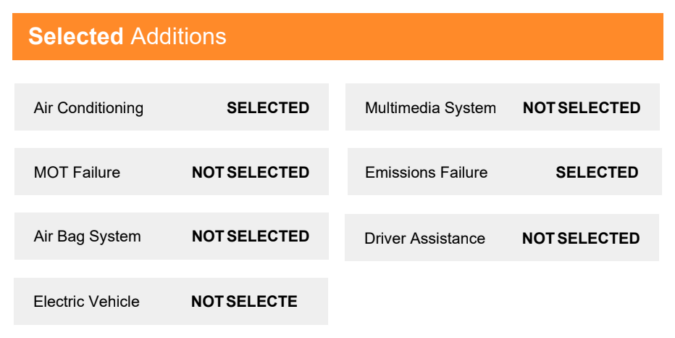

That’s not to mention the countless other perks that are offered by these aftermarket warranties, such as providing you the flexibility to tailor what sort of warranty plan you’re ideally looking for (i.e. what parts you’d need to cover and what aren’t covered), or covering for the costs of regular wear and tear on your car.